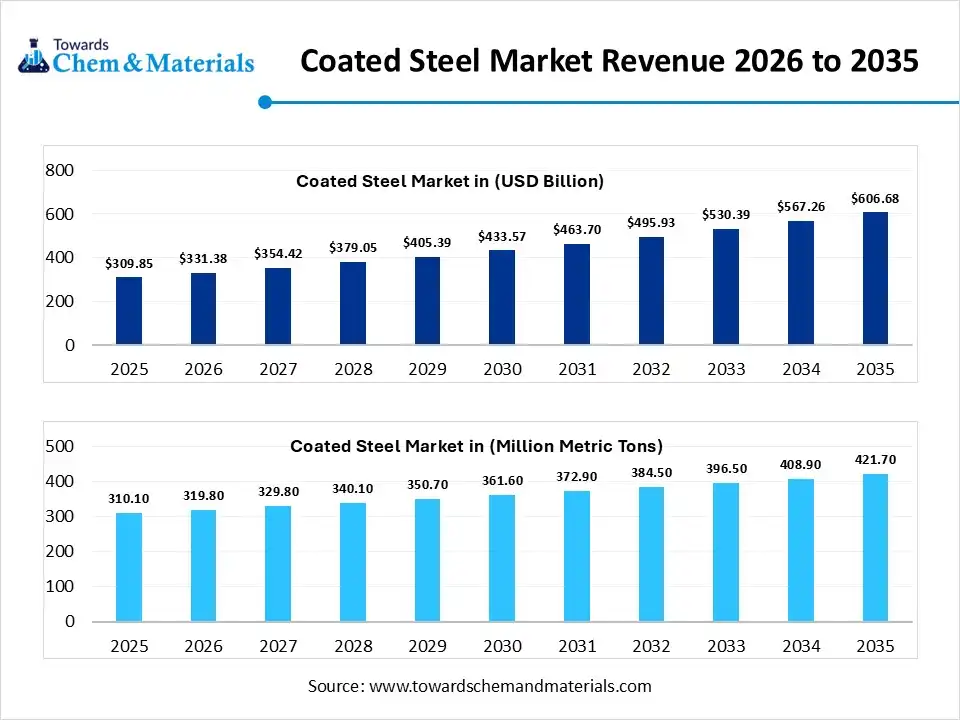

Coated Steel Market Volume to Worth 421.7 Million Metric Tons by 2035

According to Towards Chemical and Materials, the global coated steel market volume was valued at 310.1 million metric tons in 2025 to 421.7 million metric tons by 2035 exhibiting at a compound annual growth rate (CAGR) of 3.12% over the forecast period from 2026 to 2035.

Ottawa, Jan. 16, 2026 (GLOBE NEWSWIRE) -- The global coated steel market size was estimated USD 309.85 billion in 2025 and is expected to increase from USD 331.38 billion in 2026 to USD 606.68 billion by 2035, growing at a CAGR of 6.95% from 2026 to 2035. In terms of volume, the market is projected to grow from 310.1 million metric tons in 2025 to 421.7 million metric tons by 2035. growing at a CAGR of 3.12% from 2026 to 2035. Asia Pacific dominated the coated steel market with the largest volume share of 61.50% in 2025. The market is driven by urbanization, sustainability initiatives, technological advancement, and increasing demand in end-use industry applications. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6146

What is Coated Steel?

The coated steel market is experiencing growth driven by various industrial applications like automotive industry lightweighting initiatives, advanced high-strength steel grades that align with coatings, and energy-efficient building technologies. The market players investing in next-generation coatings and renewable energy integration that driving the leadership of coated steel in the market.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Coated Steel Market Report Highlights

- The Asia Pacific dominated the global coated steel market with the largest volume share of 61.50% in 2025.

- The coated steel market in North America is expected to grow at a substantial CAGR of 4.74% from 2026 to 2035.

- The Europe coated steel market segment accounted for the major volume share of 17.32% in 2025.

- By coating type, the metallic coated segment dominated the market and accounted for the largest volume share of 63.80% in 2025.

- By coating type, the organic/color coatings segment is expected to grow at the fastest CAGR of 4.27% from 2026 to 2035 in terms of volume.

- By resin type, the polyester segment led the market with the largest revenue volume share of 48.00% in 2025.

- By application area, the roofing & cladding segment dominated the market and accounted for the largest volume share of 42.00% in 2025.

- By end-use sector, the building & construction segment led the market with the largest revenue volume share of 50.00% in 2025.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6146

Coated Steel Market Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 331.38 Billion / 319.8 Million Metric Tons |

| Revenue Forecast in 2035 | USD 606.68 Billion / 421.7 Million Metric Tons |

| Growth rate | CAGR of 6.95% |

| Base year for estimation | 2025 |

| Forecast period | 2026 - 2035 |

| Quantitative Units | Value (Billion / Million), Volume (Million Metric Tons) |

| Dominant Region | Asia Pacific |

| Segments covered | By Coating Type, By Resin Type, By Application Area, By End-Use Sector, By Region |

| Key companies profiled | ArcelorMittal S.A, China Baowu Steel Group, Nippon Steel Corporation, POSCO Holdings, Tata Steel Limited, JSW Steel, Nucor Corporation, United States Steel Corporation, Thyssenkrupp Steel Europe, Ansteel Group, Voestalpine AG, SSAB AB |

Private Industry Investments for Coated Steel:

- ArcelorMittal Nippon Steel (AM/NS) India's Hazira Expansion: AM/NS India is investing approximately ₹60,000 crore (US$6.76 billion) to expand its Hazira plant's capacity to 15 million tonnes per annum (MTPA) by FY27, focusing on green steel production to meet new carbon emission norms.

- JSW Steel's Green Steel Investment: JSW Steel is set to invest over ₹50,000 crore (US$5.63 billion) to construct up to 10 MTPA of green steel capacity at its Salav plant, aiming to meet European green steel mandates and reduce carbon emissions.

- Jindal India's Odisha Plant: Jindal India received approval for a new greenfield steel facility in Odisha with a ₹3,600 crore investment, which will produce various coated steel products, including a color coating line, to increase domestic manufacturing capabilities.

- Manaksia Coated Metals' Technology Upgrade: Manaksia Coated Metals & Industries has completed an Alu-Zinc technology upgrade of its continuous galvanizing line, increasing its capacity from 132,000 MTPA to 180,000 MTPA to produce higher-value coated products.

-

BMW Industries' New Cold Rolling Unit: BMW Industries is setting up a ₹803 crore cold rolling unit in Jharkhand to produce color-coated and advanced alloy/non-alloy coated materials for various sectors like construction, automotive, and renewables.

What Are the Major Trends in the Coated Steel Market?

- Advanced Alloy Dominance: The primary trend is the adoption of multi-metallic alloy coatings and advanced products with improved corrosion resistance, replacing traditional galvanized steel.

- The Shift Towards Green Steel: The stringent environmental regulations and sustainability goals are driving demand for low-carbon and fossil-free steel options by meeting carbon mandates.

-

Renewable Energy Application: The clean energy transition is a growth engine in coating steel application infrastructure, including components for solar energy installations, wind power projects, and energy-efficient building materials

Coated Steel Market Dynamics

Driver

- Infrastructure Modernization: The significant key driver in the coated steel market is the global surge in infrastructure development and urbanization. The modern shift towards materials that offer durability and minimal maintenance.

- Sustainable Construction Standards: The rising environmental concern is driving the market towards green building certification and pushing the adoption of energy-efficient coated steel, like solar reflective panels, that lower cooling costs.

Restraint

What are the primary factors restraining the Coated Steel Industry in 2026?

The global disruption in shipping & specialized transport equipment increased lead times and higher distribution expenses. The advancement in alternative materials, like plastics, high-grade aluminium, and carbon-fibre composites challenging steel's traditional dominance and retraining the market.

Market Opportunity

How is the Growth of Solar and Wind Power Driving the Market?

The coated steel is a key material used in solar mounting frames and wind turbine towers. Due to harsh outdoor environments and the expansion of clean energy, there is a thriving opportunity for advanced alloy coatings that offer superior corrosion resistance compared to traditional galvanization.

Can AI and Internet of Things (IoT) Ensure Long-term Profitability and Coated Steel Industry Leadership?

AI used in predictive quality control and machine learning algorithms detects surface defects and adjusts coating thickness. By integrating digital tracking and sensor data in the manufacturing process, provide a digital twin of steel. The technological advancement minimizes material waste, verifies key chemical composition and coating performance for various structural applications.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Coated Steel Market Segmentation Insights

Coating Type Insights

Why did the Metallic Coated Segment Dominate the Coated Steel Market in 2025?

The metallic coated segment dominates the market due to its dual-layer defence and sacrificial protection, with the metallic layer, like zinc or magnesium-aluminium alloys, chemically reacting to shield the steel, even when scratched. This self-healing trait makes it essential for high-stress environments, such as those in renewable energy, heavy infrastructure, and automotive frames. As the industry shifts toward a circular economy and sustainability, metallic-coated steel offers durability, manufacturing flexibility, and environmental benefits, setting the global standard.

The organic/color coatings segment is anticipated to grow fastest in the market during the forecast period. By transforming steel into a high-performance, multifunctional material driven by global demand for energy-efficient architecture. The Growth is also fueled by innovations in bio-resins and low-emission formulations, premium manufacturers, and cool coatings as sustainable infrastructure. These coatings offer self-cleaning, anti-microbial, and fire-resistant properties, combining aesthetics with advanced performance, leading to high industry growth.

Resin Type Insights

Which Resin Type Segment Held the Dominating Share of the Coated Steel Market in 2025?

The polyester segment dominated the market, due to its balance of low cost, ease of processing, and performance. Polyester resin is adaptable to high-speed coil coating, keeping costs low and quality high. They are formulated for flexibility and hardness, suitable for appliances, interior partitions, and roofing. Continuous innovation has improved UV and weather resistance, ensuring long-term color retention and surface integrity. Eco-friendly, bio-based, and low-emission versions support a circular economy. Polyester's versatility and reliability make it the foundational resin for coated steel globally.

The polyvinylidene fluoride (PVDF) segment is set to experience the fastest growth, offering chemical and environmental resilience for extreme environments like UV-heavy regions. Its molecular structure resists chalking, fading, and erosion, making it ideal for architectural facades and infrastructure where maintenance costs are high. PVDF's advanced solar-reflective properties lower building thermal loads, supporting energy efficiency and sustainability goals. Its long lifecycle makes PVDF the preferred choice for those prioritizing environmental resilience and long-term value.

Application Area Insights

How did the Roofing & Cladding Segment hold the Largest Share of the Coated Steel Market?

The roofing & cladding segment dominated the market, due to its large surface area needs for building envelopes amid urbanization and industrial growth. Coated steel, due to its high strength-to-weight ratio, allows faster installation and reduced structural loads, making it essential for warehouses, commercial, and residential projects.

Its evolution into energy management tools with solar-reflective and thermal properties helps lower cooling costs to meet carbon-neutrality regulations. Providing cost-effective, durable solutions that protect against corrosion, fire, and weather, roofing and cladding drive the global market.

The solar mounting systems segment is projected to expand rapidly, driven by worldwide renewable energy expansion and carbon neutrality. Large ground-mounted solar farms require materials that withstand outdoor conditions for decades without maintenance, driving the growth. Coated steel, especially alloys like Zinc-Magnesium-Aluminium, offers superior protection against corrosion, high strength, and resistance to stresses in harsh environments. Its affordability, durability, and recyclability make solar mounting systems a key growth driver with industrial applications.

End-Use Industry Insights

Which End-Use Industry Dominated the Coated Steel Market?

The building & construction segment dominated the market in 2025, acting as the main consumer of high-volume materials for urbanization and industrial infrastructure. Coated steel's strength-to-weight ratio enables lightweight, resilient structures faster and cheaper to assemble than masonry. It also offers essential corrosion resistance for roofing, cladding, and structural framing. The sector's move toward sustainability, with smart coated steels for energy-efficient and modular buildings, provides recyclable, fire-resistant, and weatherproof solutions that meet modern demands.

The automotive segment is expected to grow at the fastest CAGR during the projected period, driven by shifts toward electric vehicles and lightweighting. Manufacturers seek high-strength coated steels for thinner, lighter components that maximize battery range while ensuring safety. These steels offer corrosion resistance and thermal protection for batteries and electric drivetrains. Rising demand for premium finishes and smart coatings with high-end aesthetics and protection further fuels growth, making automotive the primary innovation driver in markets.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6146

Regional Insights

Asia Pacific Coated Steel Market Trends

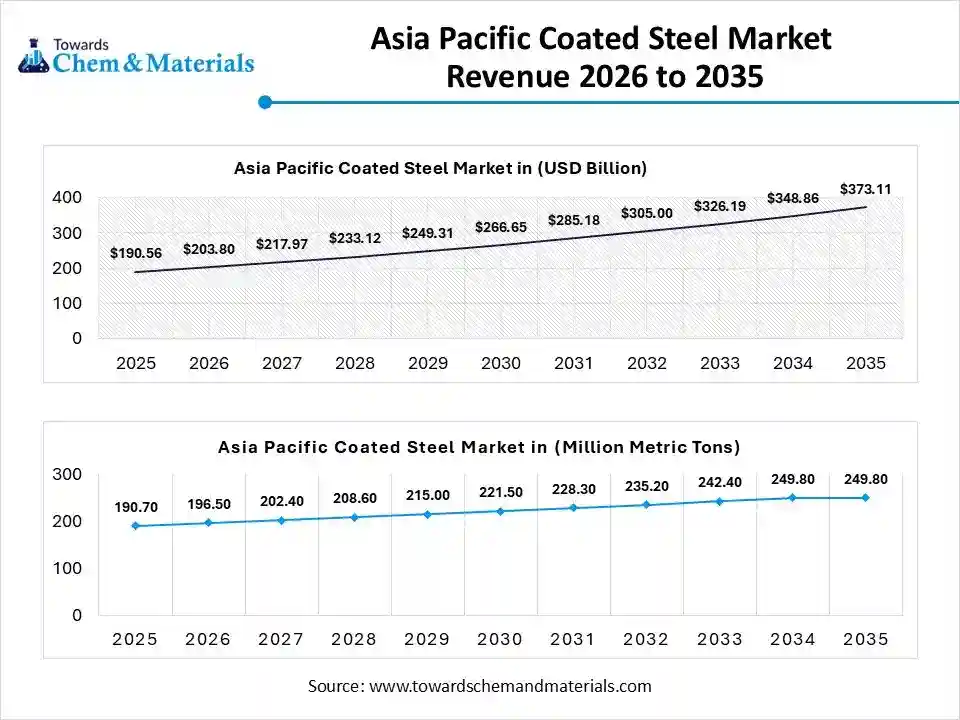

The Asia Pacific coated steel market size was valued at USD 190.56 billion in 2025 and is expected to be worth around USD 373.11 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.97% over the forecast period from 2026 to 2035.

The Asia Pacific coated steel market volume was estimated at 190.7 million metric tons in 2025 and is projected to reach 249.8 million metric tons by 2035, growing at a CAGR of 3.04% from 2026 to 2035. Asia Pacific dominated the market with a 61.50% share in 2025.

How did Asia Pacific Dominate the Global Coated Steel Market?

The Asia-Pacific region dominates the market due to rapid urbanization and manufacturing, driven by infrastructure investments and automotive and production hubs that demand high-performance materials. The region, known for large steel producers and a strong supply chain, maintains a self-sustaining ecosystem. Its leadership is supported by early adoption of advanced coating technologies, such as specialized alloys for renewable energy, making it the primary driver of global technological and industrial innovation.

Japan Coated Steel Market Trends

Japan’s market is shifting toward high-value applications focused on decarbonization and mobility. The production of premium ZMA and electro-galvanised steels for infrastructure and electric vehicles is making them a global leader. The country's push for green steel and hydrogen reduction efforts is pushing them towards domestic production and market expansion.

Why is North America the Fastest-Growing Region in the Coated Steel Industry?

North America shows significant growth driven by domestic manufacturing and infrastructure modernisation, fueled by federal incentives, new startups, and renewable energy projects. Its automotive sector’s shift to electric vehicles increases demand for specialized coated steels for batteries and lightweighting. A focus on climate change boosts the market for durable architectural coatings that meet energy standards.

U.S. Coated Steel Market Trends

The U.S. market is growing rapidly, driven by government infrastructure investments and a rebound in domestic manufacturing. Increased demand for durable, anti-corrosion materials supports critical infrastructure, energy, and electric vehicle projects. The market focuses on sustainable products and eco-friendly organic coatings using advanced alloys and coatings to meet environmental standards and demands for resilient materials.

Private Industry Investments for Coated Steel:

- ArcelorMittal Nippon Steel (AM/NS) India's Hazira Expansion: AM/NS India is investing approximately ₹60,000 crore (US$6.76 billion) to expand its Hazira plant's capacity to 15 million tonnes per annum (MTPA) by FY27, focusing on green steel production to meet new carbon emission norms.

- JSW Steel's Green Steel Investment: JSW Steel is set to invest over ₹50,000 crore (US$5.63 billion) to construct up to 10 MTPA of green steel capacity at its Salav plant, aiming to meet European green steel mandates and reduce carbon emissions.

- Jindal India's Odisha Plant: Jindal India received approval for a new greenfield steel facility in Odisha with a ₹3,600 crore investment, which will produce various coated steel products, including a color coating line, to increase domestic manufacturing capabilities.

- Manaksia Coated Metals' Technology Upgrade: Manaksia Coated Metals & Industries has completed an Alu-Zinc technology upgrade of its continuous galvanizing line, increasing its capacity from 132,000 MTPA to 180,000 MTPA to produce higher-value coated products.

-

BMW Industries' New Cold Rolling Unit: BMW Industries is setting up a ₹803 crore cold rolling unit in Jharkhand to produce color-coated and advanced alloy/non-alloy coated materials for various sectors like construction, automotive, and renewables.

What is Going on Around the Global Coated Steel Industry?

- In June 2024, JSW Steel launched JSW Magsure, a new product as Zinc-Magnesium-Aluminium alloy coated steel notes for its superior corrosion resistance. The innovation focuses on capitalization on emerging opportunities in the Indian market for applications in solar installations, guard rails, silos, and AC parts.

More Insights in Towards Chemical and Materials:

- Industrial Coatings Market Size to Hit USD 176.06 Bn by 2035

- Biopolymer Coatings Market Size to Reach USD 109.08 Bn by 2035

- Paints and Coatings Market Size to Hit USD 348.04 Bn by 2034

- Automotive OEM Coatings Market Size to Reach USD 25.25 Billion by 2034

- U.S. Conformal Coatings Market Size to Surge USD 3.16 Billion by 2034

- U.S. Powder Coatings Market Size to Hit USD 11.65 Billion by 2034

- U.S. Mirror Coatings Market Size to Surge USD 304.83 Million by 2034

- European Paints & Coatings Market Size to Hit USD 54.27 Bn by 2034

- U.S. Industrial Coatings Market Size to Hit USD 38.81 Bn by 2034

- Sustained Release Coatings Market Size to Hit USD 1,373.63 Mn by 2034

- U.S. Paints & Coatings Market Size to Reach USD 50.23 Billion by 2034

- Low-VOC Coatings Market Size to Reach USD 15.16 Billion by 2034

- Functional Coatings Market Volume to Hit 13.14 Million Tons by 2034

- U.S. Diamond Coatings Market Volume to Reach 945.31 Kilo Tons by 2034

- U.S. Fluoropolymer Coating Market Volume to Reach 39,970.6 Tons by 2034

- Wood Coatings Market Size to Worth Around USD 20.36 Bn by 2034

- Green Coatings Market Size to Surpass USD 145.19 Billion by 2035

- Wood Preservative Chemical and Coating Active Ingredient Market Size to Hit $ 5.36 Bn by 2034

- Coating Resins Market Size to Expand USD 59.71 Bn In 2025

- Powder Coatings Market Size to Surpass USD 31.26 Billion 2035

- Automotive Refinish Coating Market Size to Hit USD 25.59 Bn by 2034

- Steel Market Size to Reach USD 2.66 Trillion by 2035

- Stainless Steel-Filled Polymer Filaments Market Size to Hit USD 157.82 Mn by 2035

- Steel Casting Market Size to Hit USD 66.80 Bn by 2035

- Alloy Steel Market Size to Hit USD 170.97 Billion by 2035

- Carbon Steel Market Size to Surpass USD 1,802.47 Billion by 2035

- Waterborne Coatings Market Size to Surpass USD 166.38 Bn by 2035

- Liquid Paints & Coatings Market Size to Surge USD 246.39 Bn by 2035

- Automotive Paints & Coatings Market Size to Hit USD 48.22 Bn by 2035

Top Companies in the Coated Steel Market & Their Offerings:

- JSW Steel: Supplies Galvanised, Galvalume®, and JSW Colouron pre-painted coils primarily for the Indian construction and appliance sectors.

- Ansteel Group: Manufactures high-end Hot-Dip Galvanised and Prepainted steel tailored for the Chinese automotive and home appliance markets.

- Nucor Corporation: Offers diverse Galvanised, Galvannealed, and specialized Nucor Steel Sheet products for heavy industrial and infrastructure use.

- United States Steel Corporation: Produces high-durability coatings like ACRYLUME® and the corrosion-resistant ZMAG™ zinc-magnesium alloy.

- Thyssenkrupp Steel Europe: Focuses on premium automotive finishes and the high-efficiency ZM Ecoprotect® zinc-magnesium coating.

- Voestalpine AG: Specializes in the sustainable, chromate-free colofer® organic-coated brand and the corrender® zinc-magnesium-aluminum alloy.

-

SSAB AB: Markets the bio-based GreenCoat® color-coated range alongside high-strength Docol® metal-coated steels for vehicle safety.

Coated Steel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Coated Steel Market

By Coating Type

-

Metallic Coatings

- Hot-Dip Galvanized (HDG)

- Electro-Galvanized (EG)

- Galvalume / Aluzinc

- Zn-Al-Mg (Zinc-Aluminium-Magnesium)

-

Organic / Color Coatings

- Pre-Painted Galvanized Iron (PPGI)

- Pre-Painted Galvalume (PPGL)

-

Tinplate

By Resin Type

- Polyester (PE)

- Siliconized Modified Polyester (SMP)

- Polyvinylidene Fluoride (PVDF)

- Plastisols & Epoxies

By Application Area

- Roofing & Cladding

- Automotive Panels

- Home Appliances

- HVAC & Ducting

-

Solar Infrastructure

By End-Use Sector

- Building & Construction

- Automotive & Transportation

- Consumer Electronics & Appliances

- Packaging

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

-

Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe:

- Austria

- Russia & Belarus

- Türkiye

- Albania

-

Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6146

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.