Trends in Nonwoven Fabrics Market 2026-35

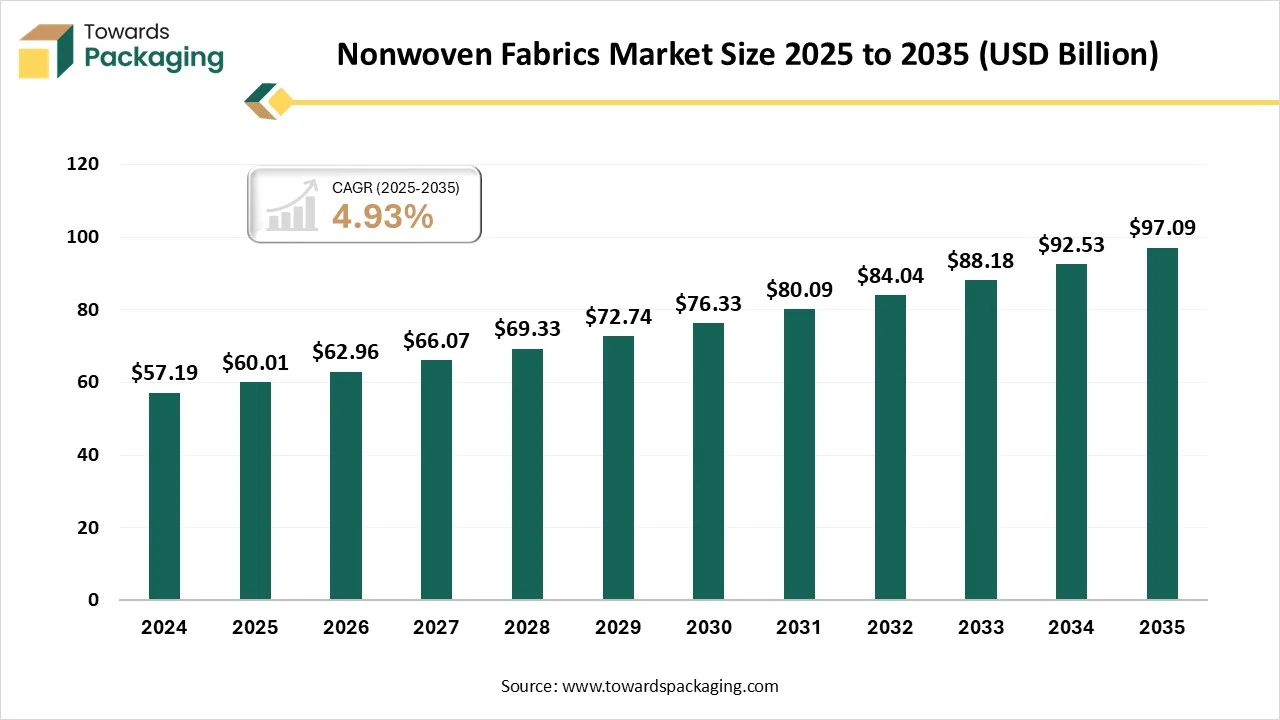

According to projections from Towards Packaging, the global nonwoven fabrics market is set to increase from USD 62.96 billion in 2026 to nearly USD 97.09 billion by 2034, reflecting a CAGR of 4.93% during 2025 to 2034.

Ottawa, Jan. 16, 2026 (GLOBE NEWSWIRE) -- The global nonwoven fabrics market reported a value of USD 60.01 billion in 2025, and according to estimates, it will reach USD 97.09 billion by 2034, as outlined in a study from Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Nonwoven Fabrics?

Non-woven fabrics are engineered textile materials made by bonding fibers together through mechanical, thermal, or chemical processes instead of weaving or knitting. They offer properties such as lightweight structure, strength, absorbency, filtration efficiency, and cost-effectiveness, making them suitable for medical, hygiene, industrial, construction, and automotive applications.

Private Industry Investments for Nonwoven Fabrics:

- Magnera Corporation (Berry Global & Glatfelter merger) A merger of Berry's Health, Hygiene, and Specialties Global Nonwovens and Films with Glatfelter formed Magnera, the world's largest nonwovens producer.

- Kimberly-Clark Corporation's North American Expansion Kimberly-Clark is investing USD 2 billion over five years in North America, including a new facility in Warren, Ohio.

- Spunweb Group's Capacity Boost Spunweb India Private Limited is increasing its installed capacity by approximately 53% with two new production lines.

- TWE Group's India Facility TWE Group is building a production site in Bhopal, India, focused initially on hygiene applications.

- Freudenberg Performance Materials' Product Launch and Acquisition Freudenberg launched new spunbond nonwovens and acquired parts of the Heytex Group, a coated technical textiles leader.

- Avgol Industries' Product Line Launch Avgol launched Avgol Hygiene 360, a product line featuring sustainable nonwoven fabrics.

- Ahlstrom-Munksjö's Filtration Expansion The company is adding a molecular filtration media line in Italy to address increasing demand.

- Fitesa's New Production Line Fitesa is adding a new spunmelt nonwovens line in Sweden for the hygiene and medical sectors.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5894

What Are the Latest Key Trends in the Nonwoven Fabrics Market?

-

Sustainable and biodegradable non-woven fabrics

Manufacturers are increasingly adopting bio-based polymers, recycled fibers, and biodegradable raw materials to reduce environmental impact. This trend is supported by stricter regulations on plastic usage and growing demand for eco-friendly hygiene, packaging, and agricultural non-woven fabric solutions.

-

Advancements in spunbond and meltblown technologies

Continuous improvements in spunbond and meltblown processes enable better fiber uniformity, higher tensile strength, and improved filtration efficiency. These advancements support the production of high-performance non-woven fabrics for medical masks, air filtration, insulation, and industrial applications.

-

Rising demand from medical and hygiene applications

The medical and hygiene sector continues to drive innovation in non-woven fabrics, focusing on enhanced breathability, barrier protection, and antimicrobial properties. Increased use of surgical gowns, wipes, diapers, and sanitary products supports consistent technological upgrades.

-

Lightweight and high-strength non-woven materials

Non-woven fabrics are increasingly engineered for lightweight yet high-strength characteristics, supporting applications in automotive interiors, construction membranes, and geotextiles. Improved fiber bonding techniques enhance durability, thermal resistance, and mechanical performance without increasing material weight.

-

Smart and functional non-woven fabrics

Integration of functional coatings, antimicrobial treatments, and sensor-compatible layers is emerging as a key trend. These smart non-woven fabrics are gaining traction in healthcare, filtration, and industrial safety applications, where performance monitoring and enhanced protection are increasingly required.

What is the Potential Growth Rate of the Nonwoven Fabrics Industry?

The growth of the nonwoven fabrics industry is driven by their widespread adoption across hygiene, medical, construction, automotive, and filtration applications due to advantages such as lightweight structure, durability, and cost efficiency. Continuous advancements in spunbond, meltblown, and airlaid technologies improve material performance, scalability, and customization.

Rising preference for disposable and single-use hygiene products supports steady demand, while increased use of non-woven fabrics in geotextiles and insulation enhances market expansion. Additionally, growing focus on sustainable manufacturing, recyclable materials, and bio-based fibers encourages innovation and long-term adoption across multiple end-use industries.

Regional Analysis:

Who is the Leader in the Nonwoven Fabrics Market?

The Asia-Pacific region holds the dominant revenue share in the market due to the rapid expansion of manufacturing capacity, increasing adoption of spunbond and meltblown technologies, and strong integration of cost-efficient production systems. Growing investments in advanced machinery, localized raw material availability, and technological upgrades support large-scale production for hygiene, medical, automotive, and industrial applications.

China Nonwoven Fabrics Market Trends

China is the fastest-growing country in the Asia-Pacific market due to its extensive manufacturing ecosystem, large-scale installation of spunbond and meltblown lines, and rapid adoption of automation and high-speed production technologies. Strong domestic equipment manufacturing, efficient supply chains, and continuous upgrades in material engineering support high-volume, cost-effective non-woven fabric production.

What is the opportunity in the Rise of North America in the Nonwoven Fabrics Market?

The North America region is estimated to be the fastest-growing region in the market due to its advanced manufacturing infrastructure, widespread adoption of high-performance spunbond and meltblown technologies, and strong presence of leading non-woven producers. The region benefits from rapid integration of automation, quality control systems, and sustainable material innovations, supporting consistent production of technically advanced non-woven fabrics across medical, hygiene, filtration, and industrial applications.

U.S. Nonwoven Fabrics Market Trends

The U.S. dominates the North American market due to its strong concentration of major non-woven manufacturers, advanced spunbond and meltblown production capacities, and continuous technological innovation. High investment in automation, material science research, and large-scale manufacturing facilities supports consistent quality and high-volume output, enabling widespread application across medical, hygiene, filtration, automotive, and industrial sectors.

How Big is the Success of the Europe Nonwoven Fabrics Industry?

Europe’s market is growing at a notable rate due to strong emphasis on advanced material engineering, high adoption of sustainable and recyclable non-woven technologies, and continuous upgrades in spunlace, airlaid, and composite non-woven processes. Well-established quality standards and innovation-driven manufacturing support expanded applications across hygiene, medical, filtration, and technical textile segments.

The UK Nonwoven Fabrics Market Trends

The UK dominates the Europe market due to its strong focus on high-value technical non-wovens, advanced spunlace and composite fabric technologies, and continuous investment in research and product innovation. Well-established manufacturing standards, automation-driven production facilities, and expertise in medical, filtration, and industrial applications further support the country’s leading position.

How Crucial is the Role of Latin America in the Nonwoven Fabrics Industry?

Latin America’s market is growing at a considerable rate due to expanding regional manufacturing capabilities, increasing installation of spunbond and needle-punched production lines, and improving access to modern processing equipment. Rising technical expertise, localized raw material sourcing, and gradual adoption of automation technologies support consistent production for hygiene, construction, and industrial non-woven fabric applications.

How Big is the Opportunity for the Growth of the Middle East and Africa Nonwoven Fabrics Industry?

The Middle East and Africa region presents strong growth opportunities in the market due to increasing investments in modern manufacturing facilities, gradual adoption of spunbond and meltblown technologies, and expanding industrial infrastructure. Improving technical capabilities, rising localization of production, and growing use of non-woven fabrics in medical, construction, and filtration applications further enhance regional growth potential.

More Insights of Towards Packaging:

- Advanced Recycled Materials (ARM) in Packaging Market Size, Trends and Segments (2026–2035)

- Recyclable Paper Wrapper Market Size, Trends and Competitive Landscape (2026–2035)

- Plastic Corrugated Sheets Market Size, Trends, Segments, Regional Outlook, and Competitive Landscape Analysis

- Consumer Goods Sustainable Packaging Market Size, Trends, Segments, Regional Outlook, and Competitive Landscape 2026-2035

- Food and Beverage Metal Cans Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Industrial Drums Market Size and Segments Outlook (2026–2035)

- Multi Depth Corrugated Box Market Size, Trends and Regional Analysis (2026–2035)

- Non-Corrugated Boxes Market Size, Trends and Regional Analysis (2026–2035)

- Inflatable Bags Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Heavy Duty Corrugated Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Airless Packaging Market Size and Segments Outlook (2026–2035)

- Pre-made Pouch Packaging Market Size, Trends and Segments (2026–2035)

- Corrugated Mailers Market Size, Trends and Regional Analysis (2026–2035)

- Green Packaging Film Market Size, Trends and Regional Analysis (2026–2035)

- Transit Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Paper Machinery Market Size, Trends and Segments (2026–2035)

- Semiconductor Packaging Market Size, Trends and Segments (2026–2035)

- Adherence Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Ethical Label Market Size, Trends and Competitive Landscape (2026–2035)

- Wine Packaging Market Size, Share, Trends, Segments, Regional Insights (NA, EU, APAC, LA, MEA), and Competitive Landscape to 2034

Segment Outlook

Technology Insights

How the Spunbond Dominated the Nonwoven Fabrics Market in 2024?

The spunbond technology segment dominates the market due to its high production efficiency, uniform fiber distribution, and excellent tensile strength. It enables cost-effective, lightweight, and durable fabrics suitable for hygiene, medical, filtration, and industrial applications.

The meltblown segment is the fastest-growing in the market due to its superior filtration efficiency, fine fiber structure, and strong barrier properties. It is widely used in medical masks, respirators, and hygiene products, meeting high-performance standards. Increasing demand for protective equipment and advanced filtration applications continues to drive its rapid adoption globally.

Material Insights

What made the polypropylene (PP) Segment Dominant in the Nonwoven Fabrics Market in 2024?

The polypropylene (PP) is the dominant segment in the market due to its excellent strength-to-weight ratio, chemical resistance, and process compatibility with spunbond and meltblown technologies. Its cost efficiency, recyclability, and ability to deliver consistent barrier, filtration, and durability performance support widespread use across hygiene, medical, filtration, and industrial applications.

The biodegradable polymer segment is the fastest-growing material in the market due to increasing environmental concerns and strict government regulations on plastic use. Rising demand for eco-friendly products in medical, hygiene, and packaging applications, coupled with advancements in bio-based polymer technologies, is driving adoption. Its sustainability, recyclability, and reduced carbon footprint further accelerate market growth.

Application Insights

Which Factors Make the Hygiene Products Segment the Dominant Segment in the Nonwoven Fabrics Market in 2024?

The hygiene products segment dominates the market due to the growing demand for disposable diapers, sanitary napkins, adult incontinence products, and wipes. Non-woven fabrics offer superior absorbency, softness, and skin-friendliness, making them ideal for personal care. Increasing awareness of hygiene, convenience, and product innovations in materials and designs further strengthens this segment’s market leadership.

The medical textiles segment is the fastest-growing application in the market due to rising demand for surgical gowns, masks, drapes, wound dressings, and protective apparel. Non-woven fabrics provide high sterility, barrier protection, and disposability, essential for healthcare settings. Technological advancements in antimicrobial and breathable nonwovens further drive adoption in hospitals and medical facilities.

End-Use Insights

What made the Healthcare and Hygiene Segment Dominant in the Nonwoven Fabrics Market in 2024?

The healthcare and hygiene segment dominates the market as it extensively uses products like surgical gowns, masks, wipes, diapers, and sanitary napkins. Non-woven fabrics offer high absorbency, sterility, comfort, and disposability, making them ideal for medical and personal care applications. Growing awareness of hygiene and rising demand for infection prevention further strengthen this segment’s dominance.

The automotive segment is the fastest-growing end-use industry in the market due to increasing demand for lightweight, durable, and sound-absorbing materials in vehicles. Non-woven fabrics are widely used in interiors, insulation, carpets, headliners, and filters, offering enhanced comfort, fuel efficiency, and sustainability. Advancements in eco-friendly and high-performance nonwovens further accelerate adoption in the automotive sector.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Nonwoven Fabrics Industry:

- In December 2025, ANDRITZ confirmed new production equipment launches for the Shanghai International Nonwovens Exhibition (SINCE 2025), including the X‑Pro crosslapper for higher throughput and the neXloom A‑Type needleloom for medium‑capacity durable non‑wovens, enhancing efficiency and web uniformity.

- In April 2025, Freudenberg Performance Materials introduced a new range of fine denier spunbond non‑woven fabrics, offering superior customization and performance across sectors like filtration, liquid management, and construction. The technology uses mono and bicomponent fibers to deliver lightweight, high‑strength materials for diverse industrial and consumer applications.

Top Companies in the Global Nonwoven Fabrics Market & Their Offerings:

Tier 1:

- Freudenberg Group: They manufacture high-performance technical nonwovens using spunlaid, meltblown, and wetlaid technologies for automotive, medical, and industrial filtration applications.

- Kimberly-Clark Corporation: They specialize in high-performance SMS, Coform, and Hydroknit laminates primarily for global hygiene brands and industrial cleaning wipes.

- Ahlstrom-Munksjö: This leader in fiber-based materials provides specialized nonwovens for medical sterilization wraps, surgical drapes, and high-efficiency filtration media.

- DuPont de Nemours, Inc.: They are the exclusive producer of Tyvek®, a unique flash-spun material used for protective apparel, medical packaging, and construction weather barriers.

- Fitesa S.A.: They focus on the high-volume production of spunmelt nonwovens specifically engineered for the global hygiene and healthcare markets.

- Glatfelter Corporation: They provide engineered materials, including airlaid and wetlaid nonwovens, for feminine hygiene, food filtration (tea/coffee), and specialty wipes.

-

Suominen Corporation: They are the world’s largest manufacturer of nonwovens used specifically for wiping products in personal care and industrial sectors.

Tier 2:

- Toray Industries, Inc.

- Johns Manville (Berkshire Hathaway)

- Hollingsworth & Vose

- TWE Group

- Sandler AG

- Low & Bonar PLC

- Pegas Nonwovens

Segment Covered in the Report

By Technology share

- Spunbond

- Meltblown

- Spunlace

- Needle-Punched

- Airlaid

- Wetlaid

- Others (Stitch Bonded, Thermal Bonded)

By Material

- Polypropylene (PP)

- Polyester (PET)

- Polyethylene (PE)

- Rayon/Viscose

- Wood Pulp & Natural Fibers

- Biodegradable Polymers (PLA, PHA, etc.)

By Application

- Hygiene Products (Diapers, Sanitary Pads, Wipes)

- Medical (Surgical Gowns, Masks, Drapes)

- Filtration (Air, Water, Industrial)

- Automotive (Upholstery, Carpets, Insulation)

- Construction (Roofing, Geotextiles, Insulation)

- Packaging

- Home Furnishings

- Agriculture Textiles

By End-Use Industry

- Healthcare & Hygiene

- Automotive

- Construction & Infrastructure

- Filtration & Industrial Processing

- Consumer Goods & Home Care

- Agriculture

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5894

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards ICT | Towards Dental | Towards EV Solutions | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Towards Packaging Releases Its Latest Insight - Check It Out:

- Bioplastic Packaging Market Size and Segments Outlook (2026–2035)

- Certified-Circular Plastic Market Analysis and Regional Outlook (2026–2035)

- PE-Free Wrappers Market Size and Segments Outlook (2026–2035)

- Agricultural Films Market Size, Trends, Segments, Regional Insights & Competitive Landscape 2025-2034

- Automotive Plastic Compounding Market Size & Business Model Innovation

- Molded Pulp Packaging Market Size, Trends, Segments, Regional Outlook & Competitive Landscape Analysis

- Plastic Healthcare Packaging Market Size, Trends and Segments (2026–2035)

- Liquid Carton Packaging Market Size, Trends and Segments (2026–2035)

- Sustainable Foodservice Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Micro Packaging Market Size and Segments Outlook (2026–2035)

- Bottle Caps Market Size, Trends and Competitive Landscape (2026–2035)

- Cosmetic Packaging Machinery Market Size and Segments Outlook (2026–2035)

- Highly Visible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Returnable Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Beer Cans Market Size, Trends and Regional Analysis (2026–2035)

- Tube Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Shrink and Stretch Sleeve Labels Market Size and Segments Outlook (2026–2035)

- Barrier Films Packaging Market Size and Segments Outlook (2026–2035)

- Cups and Lids Market Size, Trends and Segments (2026–2035)

- Rigid Bulk Packaging Market Size, Trends and Regional Analysis (2026–2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.